To have one’s taxes computed properly, using the services of an accountant in Sweden can be very useful and time-saving. No matter if you are a Swedish or foreign national or investor, you can use the services of an accountant who is also a CPA and member of the FAR (the institute for the accountancy profession in Sweden) in Sweden. CPA stands for Certified Public Accountant. Our accountants in Sweden can offer you tax advice and support.

| Quick Facts | |

|---|---|

| Accounting services available |

Tax registration, VAT and EORI registration, financial statement preparation and filing, bookkeeping |

|

Payroll services available |

YES, HR and employee and employer registration services |

|

VAT registration threshold |

Annual turnover of approx. 34,000 EUR |

| VAT rates |

25% (standard rate), 12% and 6% (reduced rates) |

| Corporate tax rate | 20. 6% |

| Dividend tax rate |

30% applied to non-residents |

| Payroll taxes |

31.42% for employers, 28.97% for sole traders and self-employed persons |

| Number of double taxation treaties (approx.) | Approx. 92 |

| Financial statement filing deadlines | Within 7 months from the end of the financial year |

| Audited financial statement filing required (YES/NO) | YES |

| VAT registration threshold | SEK 80,000 or approx. €7,800 |

|

Accounting services for sole traders (YES/NO) |

Yes, we are at the service of single business owners operating sole proprietorships in Sweden. |

|

Accounting services for SMEs (YES/NO) |

Yes |

| Accounting services available for foreign companies (YES/NO) | Yes, tailored support is granted based on the legal entity employed by the foreign company. |

| Tax minimization/planning advice (YES/NO) |

Yes, we can offer support related to tax minimization. |

| Tax consultancy services (YES/NO) |

Yes, our accountants also offer tax consultancy solutions. |

| Representation with tax authorities (YES/NO) |

Yes, our accountants can act as local representatives for tax purposes in Sweden. |

| Applicable accounting standards |

– International Financial Reporting Standards (IFRS), – accounting standards imposed by the Accounting Standards Board |

| Access to chartered Swedish accountants |

Yes, our colleagues are Swedish CPAs |

| Tax authorities in Sweden |

– Ministry of Finance, – Tax Agency |

Table of Contents

Accounting services in Sweden

Using the services of an accountant in Sweden comes with many advantages. The most important is that you obtain specialized services from someone who is up to date with all the tax-related matters.

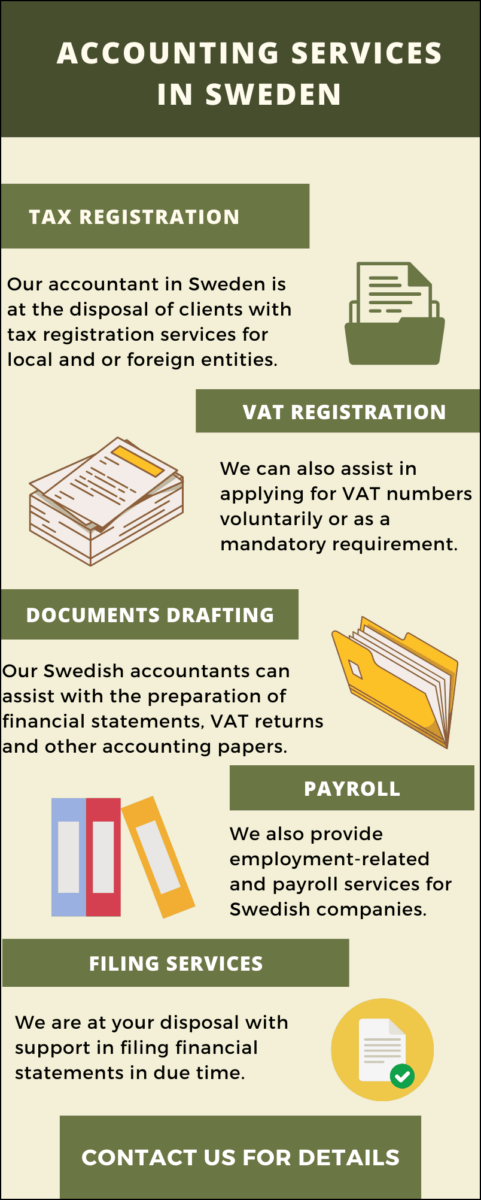

Among the accounting services you can rely on in this country, we mention the following:

- tax registration and VAT registration support for natural persons and companies;

- bookkeeping in Stockholm and other cities, payroll setup, and financial statement and filing assistance (these can also be provided separately);

- tax consultancy, planning and minimization solutions for companies (our accountant in Stockholm can help business owners in the capital city);

- audit services can also be requested with our auditors.

While our accountant can offer tailored accounting services, you can also rely on our law firm in Sweden for assistance in various legal matters. The Swedish Accounting Standards Board is a governmental organization whose major goal is to advance widely accepted accounting rules for establishing yearly accounts in Sweden. Get in touch with our Swedish accountants to increase the effectiveness and management of your financial activities in Sweden. By improving control and reporting, you can make well-informed company decisions.

Tax, VAT, and EORI registration in Sweden

No matter if you are a foreign citizen or investor who wants to open a company in Sweden, tax registration is mandatory. Our CPA in Sweden can assist you with the preparation of the documents you need to file with the local tax office.

If in the case of a foreign citizen, the procedure is simpler, setting up a business here requires more attention in terms of paperwork. Our accountant in Sweden can help business owners obtain tax and VAT numbers, as well as EORI numbers for import-export operations within the European Union.

You can use our services in major cities across the country, while our accountant in Stockholm is at your disposal if you live or have a business in the capital.

Service businesses, manufacturers, merchants, nonprofit organizations, and individuals are served by our accountants in Sweden who offer tailored accounting services. Our specialists place a strong emphasis on financial statement preparation and analysis as well as audits, tax planning, and tax preparation.

Financial statement preparation services in Sweden

The goal of accounting is to gather and present financial data regarding a company’s operations, finances, and cash flows. Following that, choices regarding how to operate the company, make investments in it, or extend credit to it are made using this information. This data is collected in accounting records through accounting transactions, which are either recorded through more specialized transactions known as journal entries or through more standardized business transactions like customer or supplier invoices.

After being registered in the accounting records, this financial data is typically combined into financial statements, which contain the following records:

- Income statement;

- Sheets showing balances;

- Cash flow statement;

- Retained earnings statement;

- Information provided with the financial accounts.

If you are seeking help regarding the financial statements of your corporations, you are welcome to get in touch with our accountants in Stockholm. They can assist you in the preparation of financial statements.

Here is also an infographic on our accounting services:

Furthermore, you can also consult with our lawyers if you need guidance about the value-added tax (VAT) in Sweden. Their assistance can help you comply well with the tax regulations. It is also advised to must seek legal help in such matters, because it is important to be compliant with the taxation of any foreign state if you want to avoid any unnecessary troubles.

Accounting obligations in Sweden

Understanding the tax and accounting obligations the company will be subject to is important before commencing the business activities.

Tax compliance is an ongoing process once investors open a company and failure to observe the rules in force results in unwanted penalties for the business.

Our accountant in Stockholm lists a number of important issues to keep in mind regarding tax and financial compliance in the country:

- accounting principles: are set forth by the Annual Accounts Act, the Swedish Accounting Standards Board and the Council, as well as the Swedish Institute of Authorized Public Accountants;

- tax year: the income year is the same as the financial year and it is a 12-month period that can end in December, April, June or August or another period that ends on the last day of any month;

- filing dates: companies observe four different filing dates, depending on the month in which their financial year ends; for example, for companies with a financial year that ends between 30 September and 31 December, the filing corporate income tax return is submitted on August 1st for electronic returns; a chartered accountant in Sweden from our tram can give you more details;

- penalties: SEK 6,250 is due for late filing, as well as a surcharge if the company omits or provides false information.

Working with a Swedish accountant is advisable in order to ensure the company’s full compliance.

Working with a team of accountants as soon as you open a company in Sweden is advisable in order to ensure compliance with the tax requirements. Our team can give you more details about the registration for the Swedish Tax Agency (which needs to take place after the registration with the Companies Registration Office), as well as the approval for the Swedish F-tax. You can also rely on us for bookkeeping in Stockholm.

Payroll services in Sweden

Businesses have the option of outsourcing all or a portion of their administrative duties to a third-party company that manages payroll. The following roles and tasks are covered by our accountant in Sweden:

- Data gathering and payroll computation: take control of and double-check all input data and relevant information to execute a precise payroll calculation, a gross-to-net calculation of all employee deductions, taxes, and net salaries in accordance with the law; making off-cycle payments computable;

- Managing benefits and bonuses: Benefits and bonuses are calculated using the available programs, such as medical or life insurance, pension plans, vacation time, sick leave, and maternity leave;

- Distribution of pay slips and payment management: creating pay slips in hard copy and password-protected PDF files, sending them to employees via email or storing them on their online self-service portal; creating payment orders and distributing funds to employees and local governments;

- Regular payroll-related statutory reporting: Payroll-related statutory reporting and submission to Swedish authorities, including the Tax Office, Labor Office, social and health insurance firms, statistics offices, and others, as well as ongoing communication with these authorities;

- Taxation of individuals: calculation and submission of personal income tax forms, including support to employees in gathering the required data and paperwork;

- Reporting to management: Regular standard reporting package within the specified scope, as well as any additional customized reports required by your management.

If you need any additional services, you can get in touch with our CPA in Sweden (Certified Public Accountant). They can offer you efficient services in this regard.

In addition to these accounting services in Sweden, our lawyers can also assist you in other matters. For instance, if you want a virtual office in Sweden, our lawyers can help you get it.

Bookkeeping services in Sweden

The regular recording of a business’s financial activities is known as bookkeeping. With the aid of efficient bookkeeping, companies can keep track of all the data on their books to make essential operating, investment, and finance decisions. Proper bookkeeping enables accurate measurement of a company’s performance. It also acts as a point of reference for its income and revenue targets and a source of information for all other strategic decisions. In other words, once a business is up and running, it is critical to devote more time and money to maintain correct records.

If you need an accountant in Sweden for the bookkeeping services, you can get in touch with our agents. They can provide you with efficient services in this regard.

Besides bookkeeping in Stockholm, our lawyers can provide you with practical assistance if you want to open a firm in this country.

Tailored support for companies in Sweden

Setting up a business in Sweden implies completing various tasks related to its accounting system. Amon these:

- registration for employment purposes of the company and employees;

- hiring personnel and setting up the payroll;

- drafting specific documents related to the payment of labor taxes, employees’ leaves for various reasons, and other employment-related matters;

- keeping employees’ records updated every time a person is hired or leaves the enterprise.

These procedures require a lot of attention, and an external accountant in Sweden can handle such matters without interruptions.

FAR is Sweden’s institution for certified accountants and auditors, and our specialists are members of this association.

If you need the services of a CPA in Sweden, our accountants and auditors are at your disposal.

Here is our video on this subject:

How to find an accountant in Sweden

There are a little over 5,000 FAR-certified accountants in Sweden a population of 10.3 million citizens. So, finding a CPA is not difficult. These are present both in small and larger cities, even finding an accountant in Stockholm is easier.

When it comes to the taxes to be paid in Sweden, here are the main highlights:

- the personal income tax rate is 20% and applies to earnings of more than 540,700 SK;

- non-residents are levied a 25% flat tax rate on the income obtained in Sweden;

- to this national levy, an additional 32% municipal tax 32% applies to the entire income of a natural person;

- the corporate tax is 20.6%, while the VAT is applied at a standard rate of 25%.

For more information on taxation and our services, contact our accountant in Sweden.